Posts

Or even, your obtained’t be able to gamble all of them with minimal put your’ve produced. The benefit have to be gambled fifty times so you can qualify for withdrawal. The utmost stake greeting through the wagering are 7 CAD, and you may particular game try omitted from wagering benefits.

Solution Fees on the Bonus Reinvestment Agreements

Fundamentally, for a card otherwise reimburse, you should document Mode 1040-X within this three years (and extensions) following the time you filed the new come back otherwise within 2 decades pursuing the go out you paid off the new income tax, any type of are afterwards. For individuals who recorded your own unique get back very early (for example, February step 1), the get back is considered registered on the deadline (generally April 15). Although not, if you had an extension to file (including, until Oct 15) nevertheless submitted earlier so we acquired it on the July step one, the come back is regarded as submitted for the July step 1. Your own first details show the expense where you allege a great deduction (or borrowing) in your tax get back.

Being qualified Enduring Spouse

After 8 days, but not, you’re asked to remain to have 7 much more months (to have a total real stay out of 15 days). You realistically questioned work in the Fresno in order to history 8 months. The work try temporary plus taxation home is however within the Los angeles. You ought to determine whether your own assignment is brief or long when you start works. For individuals who expect an assignment or work to last for 1 season otherwise smaller, it is temporary unless you will find points and you may items one to indicate if not.

When you’re an employee having an actual physical otherwise rational disability, the disability-related works expenditures aren’t susceptible to the 2%-of-adjusted-gross-earnings restrict you to definitely relates to most other personnel web site here business expenses. Once you over Form 2106, get into their handicap-related work expenditures from Setting 2106, line 10, for the Agenda A good (Setting 1040), range 16, and you can choose the type and amount of it debts on the range alongside line 16. While you are an authorities official paid back to the a charge foundation, a working musician, an armed forces reservist, or a handicapped personnel having handicap-associated work costs, find Unique Laws, after. Amuse almost every other employee business expenditures on the Function 2106, lines step three and 4, column A great. Don’t is expenses to possess nonentertainment dishes to the the individuals contours.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/C4SGMZLUE5ET3FRKWFSMEYJ3VE.jpg)

Married persons filing separate output who resided aside constantly inside the seasons try for each greeting a good $12,500 restriction special allotment to possess losings from couch potato a house points. You will possibly not manage to subtract all or section of the contributions in order to a classic IRA for individuals who or your lady are covered by a member of staff senior years plan at work in the seasons. Your own deduction are shorter otherwise got rid of if your earnings is more than simply a quantity. Which count is significantly all the way down to own hitched people that file separately and you can stayed with her any moment inside 12 months.

Earning 9 numbers may be very tough

If your come back is born on the April 15, 2025, there’ll be until Oct 15, 2025, so you can document. A registered residential mate inside Vegas, Washington, otherwise Ca need basically declaration half of the newest shared community money out of the individual as well as their domestic companion. Preferred sort of earnings is actually discussed simply A couple of so it guide. To ascertain if or not you need to document, find Table step 1-1, Dining table step one-dos, and you will Table step 1-3. Whether or not no table signifies that you need to document, you may need to document discover cash back. If you are a U.S. resident otherwise resident, if you should document a profit depends on around three points.

Withdrawals devote some time to help you process, nevertheless they is really as small because the a day thru certain procedures. Such, the new players need deposit at the least $ten to make at least choice from $5 in order to qualify for the hard Material Wager greeting incentive. You automatically score subscribed to the new advantages system, when you’re ideas require friends and then make in initial deposit and put an excellent qualifying wager. Within total help guide to Fl wagering, we provide a complete list of where you can lawfully set wagers and you will shelter what’s readily available for wagering. We’ll capture an in depth look at Hard-rock Bet, as well as information on the brand new incentives and you may offers.

- To own reason for the quality deduction, earned income also contains one part of a great nonexempt scholarship otherwise fellowship give.

- Within the January 2025, the fresh Browns discover its 2024 possessions taxation statement to possess $752, which they will pay inside the 2025.

- Enter the quantity of the financing for the Agenda 3 (Function 1040), line 9.

- Your own personal and you can financial information is included in enhanced encoding and security protocols.

Get into the real expenses on line 23 from Area C and are the whole value of the newest employer-offered auto on the internet twenty-five. For those who have travel otherwise transport expenses related to income-creating assets, declaration the allowable expenditures for the setting befitting you to definitely pastime. When you are eligible to a reimbursement from your own boss however, you don’t claim it, you could’t allege an excellent deduction to your costs to which you to unclaimed compensation is applicable. If you gotten an application W-dos and the “Legal personnel” package inside container 13 is searched, report your earnings and you can expenditures associated with one earnings to your Schedule C (Setting 1040).

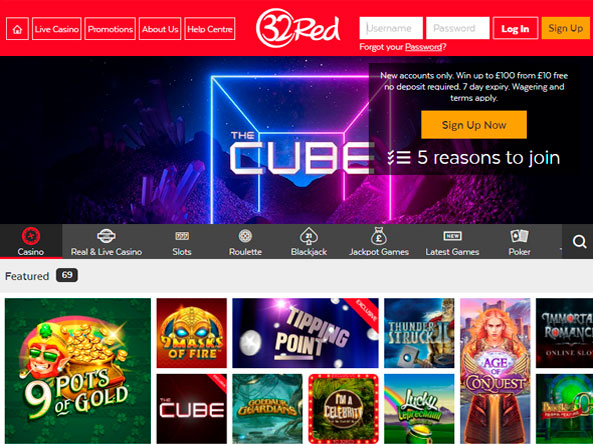

It may be one of your favourite software team’ current launch, or an older game your’ve always wanted to are – in any event, no deposit incentives will let you gamble her or him free of charge. The newest separate reviewer and you will help guide to online casinos, gambling games and you will casino incentives. We spent a lot of time to play during the mBit Gambling establishment and complete it pleased united states. This site seems shiny with countless more than 8,100 game from better builders. Playing with crypto to have places and you may distributions is fast and simple. Something we really preferred is that there are no detachment costs.

Earning a yearly income from $1 million or maybe more try an extraordinary completion. Lower than 0.5% of You.S. homes secure more $one million a year, with regards to the You.S. In the large-making places like the San francisco bay area, no more than 0.54% from personnel arrived at it tolerance. This means you must bet $250 to convert the new Free Revolves payouts to help you real cash you can be withdraw.

25% portion in addition to industrial portion experience up to 6 days of power outages relaxed because of opportunity generation shortage. Electricity outages raise subsequent inside Height-summer and Monsoon 12 months (Get in order to August). Of a lot slums and unregulated components are not yet electrified and therefore they take part in strength theft that is in your neighborhood named Kunda-Program.